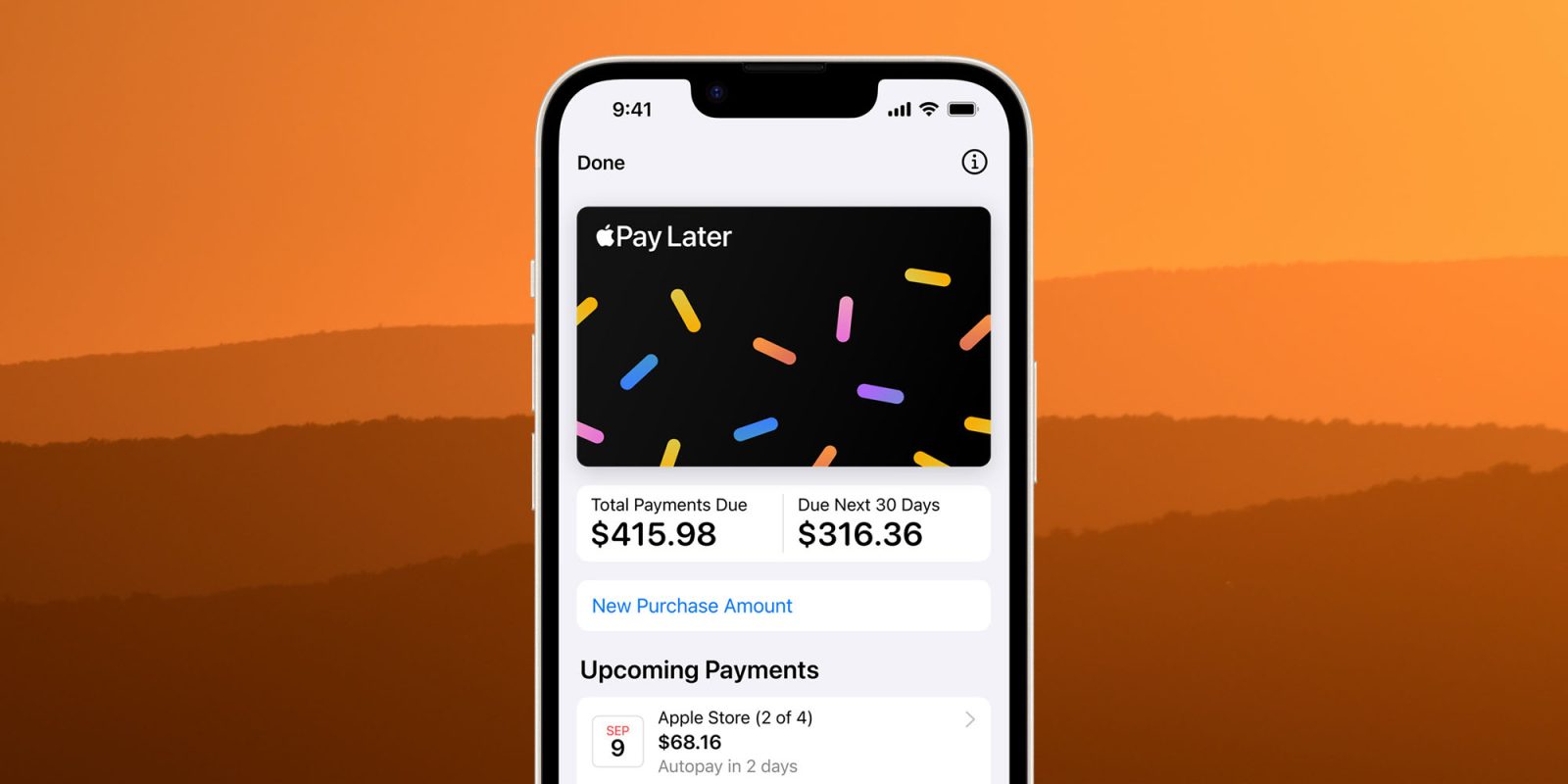

We speculated at the time that the decision to withdraw Apple Pay Later was probably driven by a desire to get ahead of upcoming legislation, and a piece today suggests that it’s actually a new interpretation of a very old law.

The Truth in Lending Act was passed in 1968, and grants consumers a number of protections when it comes to credit cards – and Apple Pay Later seemed set to fall within scope …

Apple Pay Later would be subject to TiLA

The Truth in Lending Act (TiLA) is a federal law passed in 1968 which regulates the credit card industry. It sets out a range of obligations card companies have to meet, and sets out consumer rights which apply to purchase made with a credit card.

None of it applied to Buy Now, Pay Later (BNPL) loans like Apple Pay Later – but that’s changing.

The US Consumer Financial Protection Bureau (CFPB) launched an investigation into these loans back in 2021, and last month proposed that they fall within the scope of the TiLA.

[The Bureau] is issuing this interpretive rule to address the applicability of subpart B of Regulation Z to lenders that issue digital user accounts used to access credit, including to those lenders that market loans as “Buy Now, Pay Later” (BNPL). This interpretive rule describes how these lenders meet the criteria for being “card issuers” for purposes of Regulation Z. Such lenders that extend credit are also “creditors” subject to subpart B of Regulation Z, including those provisions governing periodic statements and billing disputes.

Essentially, this means that BNPL lenders have to be much more careful about their lending decisions, as Arstechnica reports.

“When consumers check out and choose Buy Now, Pay Later, they don’t know if they will get a refund if they return their product or whether the lender will help them if they didn’t get what was promised,” said CFPB Director Rohit Chopra. “Regardless of whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under longstanding laws and regulations already on the books.”

By getting out of the BNPL game, Apple can avoid requirements that the CFPB plans to impose on BNPL lenders, including potential obligations to investigate customer disputes, pause payments, provide refunds, and issue credits when necessary.

It’s not that Apple would have engaged in any sketchy behavior, but the decision – if finalized – would have created a lot of potential paperwork for the company. Given the relatively small boost in sales that would have been achieved by such short-term loans, it’s likely Apple decided it simply didn’t want the headaches.

9to5Mac collage of images from Apple and Taylor Wright on Unsplash

FTC: We use income earning auto affiliate links. More.

6 months ago

72

6 months ago

72

English (US) ·

English (US) ·