After cutting interest rates for the Apple Card Savings Account last month, Apple and Goldman Sachs are cutting interest rates again. Customers were notified of the change on Thursday night, and it will take effect on Friday, October 11.

Apple Card Savings Account interest rate to be cut again

Apple Card Savings Account started with a 4.15% interest rate for the first eight months of availability. The rate increased to 4.25% in December of last year, then again to 4.35% in early January and to 4.5% in late January. The rate was then cut back to 4.4% in April and then reduced to 4.25% in late September.

Changes in the interest rate for savings accounts follow decisions by the US Federal Reserve and are expected in these cases.

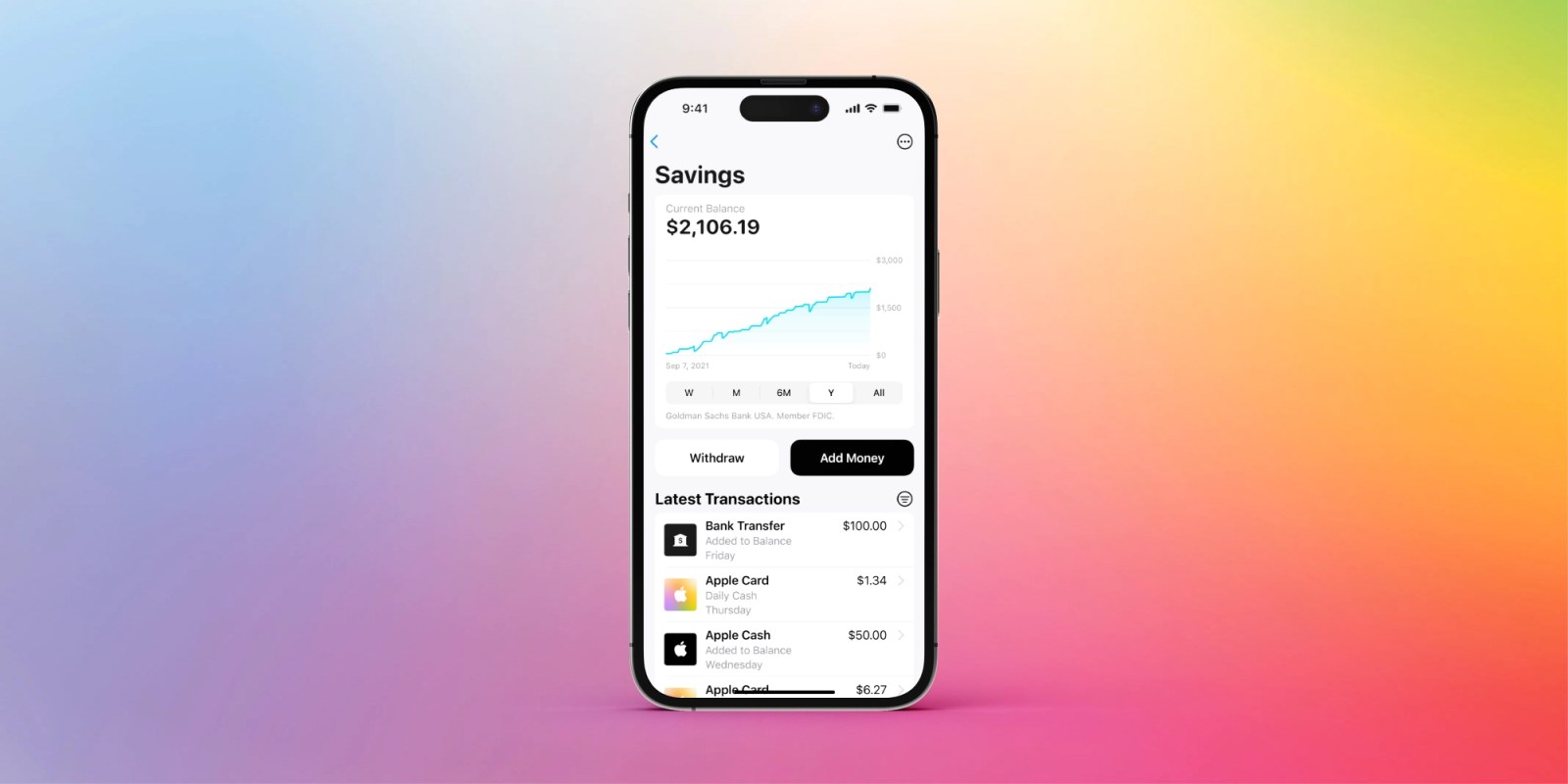

The Apple Card Savings Account is a benefit available exclusively to Apple Card holders. Customers can automatically deposit their Daily Cash into into the high-yield savings account within the Wallet app. Apple Card users can also add funds from a linked bank account or their Apple Cash balance.

For those unfamilar, Apple Card is the credit card designed by Apple and backed by Goldman Sachs. It offers a variety of perks and rewards, including 0% financing on Apple products. The application process for Apple Card is incredibly straightforward. Once you’re invited to apply, you can do so directly in the Wallet app on iPhone.

You can learn more about Apple Card Savings Account in our in-depth guide right here.

Read also

- Is the Apple Card worth it? Here’s what you need to know

- WSJ: Apple Card could switch from Goldman Sachs to Chase and change ‘key’ features

- What if Apple made a travel focused Apple Card?

- Apple Card best free co-branded credit card, says JD Power survey

- The changes I’d like to see in an Apple Card revamp

- Apple shares trio of new ads pitching why you should ‘Reboot your credit card’ [Videos]

- Replacing your expired Apple Card? Apple wants your old piece of titanium back

FTC: We use income earning auto affiliate links. More.

1 month ago

12

1 month ago

12

English (US) ·

English (US) ·