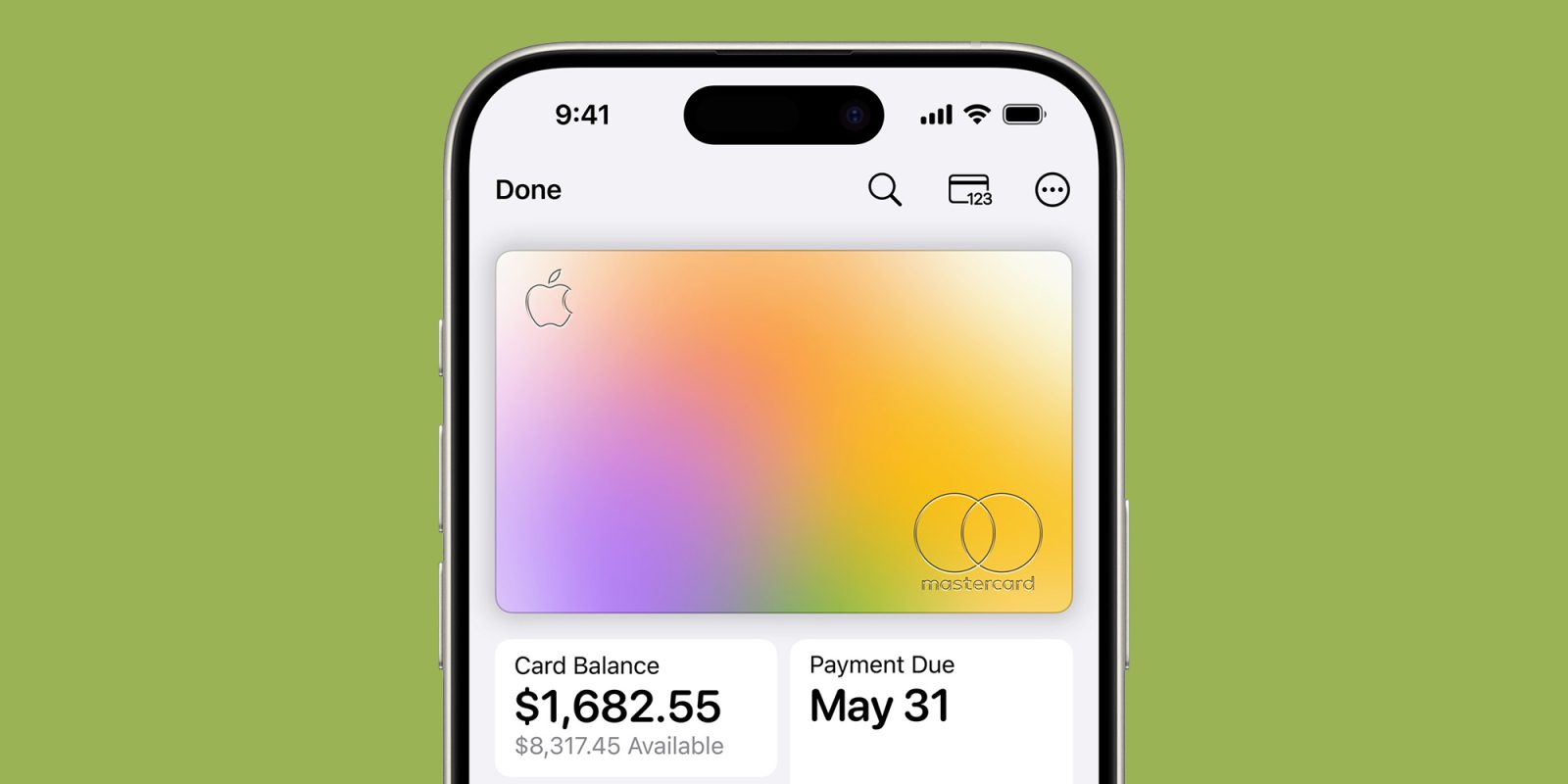

The JD Power 2024 US Credit Card Satisfaction Study has found the Apple Card to be the best co-branded credit card with no annual fee …

Apple says it’s the fourth consecutive year the card has “been awarded a No. 1 ranking,” though the actual categories have varied:

- 2021: Best Midsize Credit Card Issuer

- 2022: Best Midsize Credit Card Issuer

- 2023: Best Co-Brand Credit Card – No Annual Fee segment (excluding airline cards)

- 2024: Best Co-Brand Credit Card – No Annual Fee segment (excluding airline cards)

The awards are based on customer satisfaction ratings, factoring in scores for categories like Account Management, Customer Service, and New Account Experience.

Apple highlighted the key features of the card:

Introduced in 2019, Apple Card was built with users’ financial health in mind. Apple Card has absolutely no fees and is designed to offer users an easy and secure way to track purchases and manage spending from Wallet while receiving up to three percent Daily Cash on every purchase.

With Apple Card Family, users can also share an Apple Card account with anyone added to their Family Sharing group.

Users can also open a Savings account through Apple Card and choose to have their Daily Cash automatically deposited there, allowing users to get even more value from their Daily Cash. Savings comes with no fees, no minimum deposits, and no minimum balance requirements, and also allows users to transfer additional funds from a linked bank account to further grow their savings.

The APR charged on card balances depends on your credit score, and ranges from 19.24% to 29.49%.

Image: Apple

FTC: We use income earning auto affiliate links. More.

3 months ago

21

3 months ago

21

English (US) ·

English (US) ·