Joe Hindy / Android Authority

TL;DR

- As expected, the EU is happy with Apple’s concessions for opening NFC payments.

- While the larger points had already been agreed upon, negotiations continued in response to third-party concerns.

- Even with mobile payments sorted, Apple still has a lot of work to do to achieve full Digital Markets Act compliance.

The European Commission and its passion for open access continue to be the most wonderful thorn in the side of big tech. Time and time again, we’ve seen EU regulatory authorities hold some of the largest companies on the planet accountable for their anti-competitive practices and bend their will for the good of consumers. The Digital Markets Act (DMA), in particular, has been a real force for change, and its impact on everything from app stores to search results is already being felt.

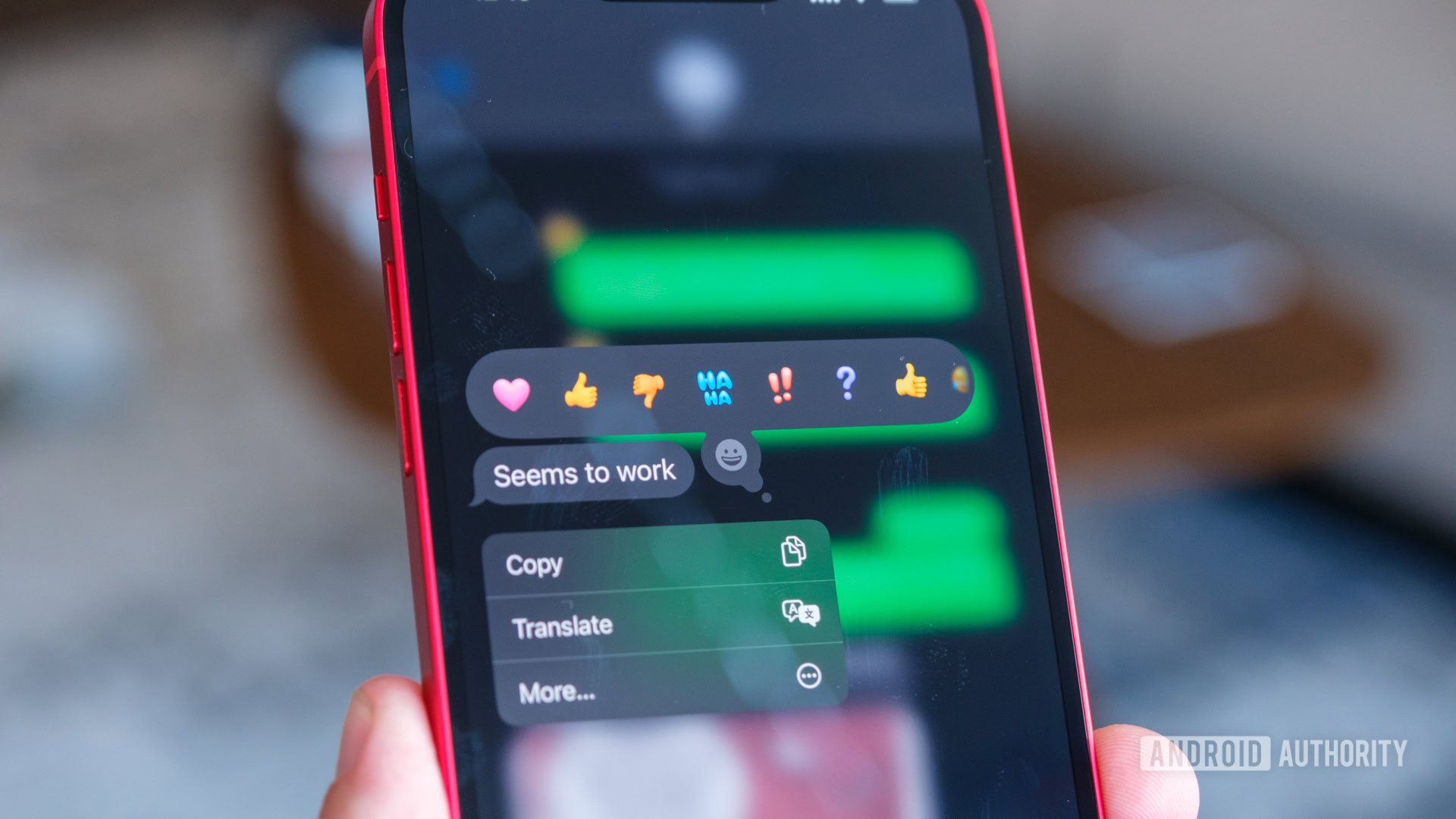

One of the many changes Apple has had to face as a result of the DMA is a requirement to open up NFC-based tap-to-pay functionality on iPhones to third-party wallets, so users wouldn’t be forced to use Apple Pay. Today, the EC announced that it has accepted Apple’s revised commitments to addressing the Commission’s concerns (via Reuters), locking the company into a binding agreement.

Apple had already agreed to a lot of the major points of this arrangement, and as we reported last month, it was already looking good that Apple was going to make the EC happy when it came to opening NFC payments. In its statement today, the EC shares some of the additional points Apple has agreed to in the interests of satisfying the concerns of affected parties. Those include concessions like allowing users to easily set default payment cards, removing some licensing requirements, and allowing devs to pre-build and market wallet solutions to other parties.

EC executive VP Margrethe Vestager shares the Commission’s good news:

It is safe and convenient to pay with your phone. Apple has committed to allow rivals to access the ‘tap and go’ technology of iPhones. Today’s decision makes Apple’ commitments binding. It opens up competition in this crucial sector, by preventing Apple from excluding other mobile wallets from the iPhone’s ecosystem. From now on, competitors will be able to effectively compete with Apple Pay for mobile payments with the iPhone in shops. So consumers will have a wider range of safe and innovative mobile wallets to choose from.

Of course, this is just one battle in the EC’s war against anti-competition, but it’s not like there’s any sign of it backing down now. If anything, 2024 has seen a reinvigorated Europe pushing back against Core Platforms Services (CPS) providers like Apple and Google, particularly in the time since the March deadline for DMA compliance passed. Apple may have largely let the EC have this one, but it could just be saving its energy for future battles.

Got a tip? Talk to us! Email our staff at [email protected]. You can stay anonymous or get credit for the info, it's your choice.

English (US) ·

English (US) ·